How to Lease Lexus: A Step-by-Step Guide

How to Lease Lexus: Leasing a luxury vehicle like a Lexus offers an attractive way to drive a premium car without the long-term commitment of buying.

Whether you’re drawn to the reliability of a Lexus sedan, the versatility of an SUV, or the performance of a sports model, understanding the leasing process helps you secure the best possible deal.

This comprehensive guide walks you through everything you need to know about getting behind the wheel of your dream Lexus.

Also Read: A Guide to Lincoln Corsair and Cadillac XT5 Comparison

Short Answer About How To Lease Lexus

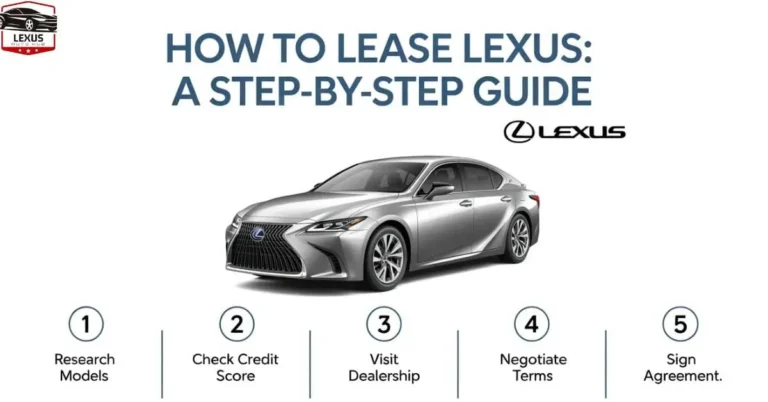

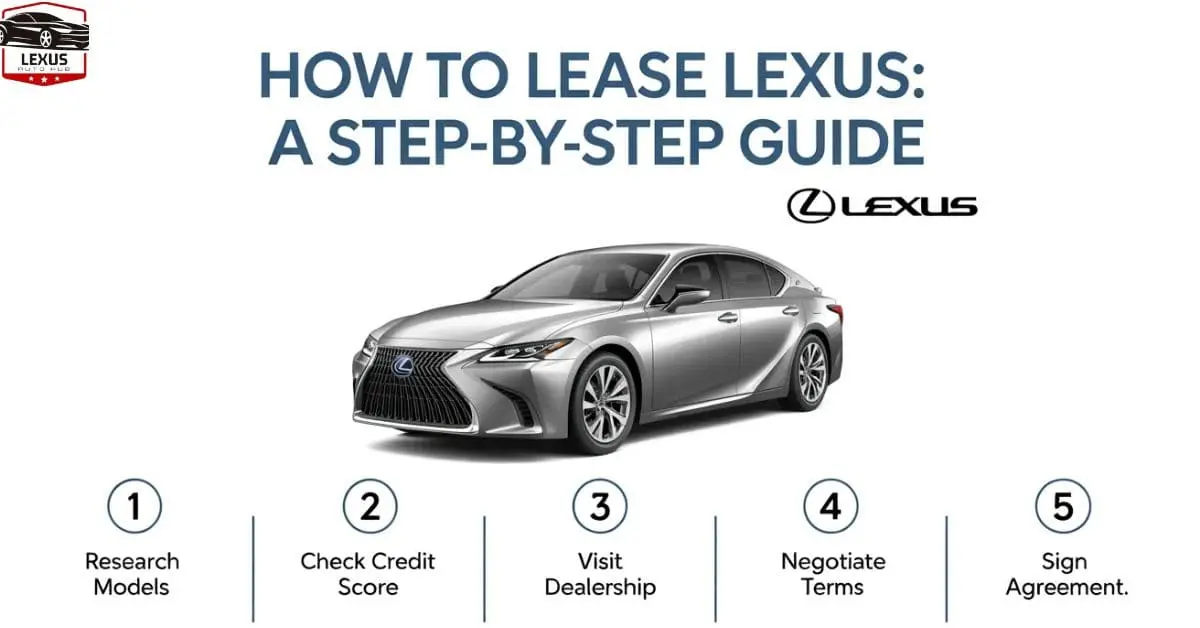

Leasing a Lexus is a popular way to drive a luxury vehicle without committing to a full purchase. To start, research the Lexus model you want, including available trims, features, and current lease offers from dealerships.

It’s important to check your credit score and understand key lease terms such as monthly payments, mileage limits, and any required down payment. Visiting a Lexus dealership allows you to negotiate the lease, review the agreement carefully, and ensure you understand all conditions.

Proper vehicle maintenance during the lease term is essential to avoid extra fees, and at the end of the lease, you can return the car or explore purchase options.

Understanding the Basics: How To Lease Lexus

Before visiting a dealership, it’s essential to understand what leasing actually means. When you lease a Lexus, you’re essentially renting the vehicle for a predetermined period, typically two to four years. You make monthly payments based on the car’s depreciation during your lease term, plus interest and fees. At the end of the lease, you return the vehicle or have the option to purchase it.

Leasing differs fundamentally from buying. You don’t own the car, which means you’ll face mileage restrictions and must maintain the vehicle according to Lexus standards. However, you also avoid long-term depreciation concerns and can drive a new Lexus every few years. Understanding how to lease Lexus vehicles starts with recognizing these trade-offs and determining if leasing aligns with your lifestyle and financial goals.

The appeal of leasing a Lexus specifically lies in the brand’s reputation for reliability and luxury. Lexus vehicles hold their value well, which translates to reasonable lease payments. Additionally, Lexus Financial Services often offers competitive lease programs with attractive terms, especially during promotional periods.

Also Read: Steps to Analyze Lexus GX 460 Competitors Effectively 2026

Researching Models: How To Lease Lexus Options

The first practical step in how to lease Lexus is deciding which model suits your needs. Lexus offers an impressive range of vehicles, from the compact UX crossover to the luxurious LS sedan and the three-row TX SUV. Each model comes with different lease terms, residual values, and monthly payments.

The Lexus IS and ES sedans appeal to buyers wanting refined transportation with excellent fuel economy. The NX and RX crossovers dominate Lexus lease portfolios due to their versatility and popularity.

Performance enthusiasts gravitate toward the RC coupe or the powerful LC. Luxury seekers might prefer the LS flagship sedan or the LX SUV for maximum prestige. When learning how to lease Lexus vehicles, research current lease offers on the Lexus website and third-party automotive sites.

Lexus frequently runs special lease programs on specific models, offering reduced down payments or lower monthly payments. Pay attention to which models are being heavily promoted, as these often represent the best lease values.

Consider your actual needs rather than wants. If you primarily commute alone, a compact UX might serve you better than a larger RX, even if the RX seems more appealing. The smaller vehicle will likely have lower monthly payments and better fuel economy, saving money throughout your lease term.

Also Read: Lexus TX Competitors: How to Compare Best 2026

Checking Your Credit: How To Lease Lexus With Good Terms

Your credit score significantly impacts lease terms, making credit preparation a crucial aspect of how to lease Lexus successfully. Lexus Financial Services, like all lenders, uses your credit score to determine your interest rate (called the money factor in leasing) and whether to approve your application.

Excellent credit (scores above 720) qualifies you for the best lease rates and promotional offers advertised by Lexus. Good credit (680-719) still gets favorable terms but might not qualify for the absolute best deals. Fair credit (620-679) means higher money factors and possibly larger down payments. Poor credit (below 620) makes leasing challenging and expensive, though not impossible.

Before approaching a Lexus dealer, check your credit reports from all three major bureaus. Look for errors that might be dragging down your score and dispute any inaccuracies. If your credit needs improvement, consider waiting a few months while you pay down debts and make on-time payments to boost your score.

Understanding how to lease Lexus with optimal terms means knowing your creditworthiness and being realistic about what deals you’ll qualify for. If your credit is marginal, focus on building a relationship with one dealership rather than shopping around extensively, as multiple credit inquiries can temporarily lower your score.

Also Read: Lexus NX Competitors: How to Choose the Best 2026

Determining Your Budget: How To Lease Lexus Affordably

Financial planning is central to how to lease Lexus responsibly. Start by determining what you can comfortably afford in monthly payments. Financial advisors typically recommend keeping total vehicle expenses (payment, insurance, gas, maintenance) below 15-20% of your gross monthly income.

Remember that the advertised lease payment rarely tells the whole story. Lexus lease advertisements usually show the lowest possible payment, which assumes a specific down payment, excellent credit, and possibly a trade-in.

Your actual payment will likely be higher. When calculating your budget, include the down payment (or capitalized cost reduction), acquisition fees, first month’s payment, registration, and taxes due at signing.

Many people learning how to lease Lexus make the mistake of focusing solely on monthly payments. A dealer can always lower your monthly payment by increasing the down payment or extending the lease term, but this doesn’t necessarily mean you’re getting a better deal. Instead, focus on the total cost of the lease, including all upfront fees and the sum of all monthly payments.

Also budget for insurance, which will be higher for a Lexus than for a mainstream brand. Leased vehicles require comprehensive and collision coverage with specific minimum limits. Get insurance quotes before committing to a lease to avoid unpleasant surprises.

Also Read: A Guide to Evaluating Lexus RX Competitors Effectively 2026

Timing Your Lease: How To Lease Lexus at the Right Moment

When you decide to lease matters almost as much as what you lease. Understanding how to lease Lexus at the optimal time can save thousands of dollars over your lease term. Dealerships and manufacturers offer varying incentives throughout the year, making some months significantly better for leasing than others.

End of month timing provides leverage when negotiating how to lease Lexus. Salespeople and dealerships have monthly quotas, making them more willing to negotiate during the last week of the month.

End of quarter (March, June, September, December) is even better, as manufacturer incentives often increase and dealers push harder to meet quarterly targets. Model year transitions present excellent opportunities.

When the new model year arrives (typically in fall), dealers need to clear out remaining current-year inventory. Lexus often increases lease incentives on outgoing model years, resulting in substantially lower payments. The vehicles are still new, just carrying the previous model year designation.

Holiday weekends like Memorial Day, Fourth of July, and Labor Day traditionally feature aggressive lease promotions. Lexus often runs special lease programs during these periods, combining manufacturer incentives with dealer discounts. December can also be excellent, as dealers try to meet annual sales goals before year-end.

Learning how to lease Lexus successfully means being flexible with timing when possible. If your current lease ends in April but you can extend it a few months, waiting until summer or fall might result in significantly better terms on your next Lexus.

Negotiating the Price: How To Lease Lexus for Less

Many people don’t realize that the purchase price of the vehicle affects lease payments. The lower the negotiated price, the lower your monthly payment will be. This is a critical component of how to lease Lexus effectively. You’re not stuck with sticker price just because you’re leasing.

The negotiation should focus on the capitalized cost (the vehicle’s selling price in lease terminology) rather than monthly payments. If you start by discussing monthly payments, the dealer can manipulate various factors to hit your target number while not actually giving you the best deal.

Research the fair market value of the Lexus model you want using resources like Edmunds, Kelley Blue Book, and TrueCar. These sites provide dealer invoice prices and current market prices in your area. Aim to negotiate a capitalized cost close to the dealer invoice price, especially on models with current incentives.

When learning how to lease Lexus vehicles, understand that dealers make money multiple ways: profit on the selling price, markup on the money factor, dealer fees, and back-end products like extended warranties. The capitalized cost is the most transparent area where you can clearly save money through negotiation.

Don’t reveal that you’re leasing until after negotiating the vehicle price. Some salespeople treat lease customers differently, assuming they’re only focused on monthly payments. Negotiate as if you’re buying, then once you’ve agreed on price, discuss lease terms.

Also Read: Lexus NX vs Acura RDX: The Ultimate Showdown

Understanding Lease Terms: How To Lease Lexus With Favorable Conditions

The lease contract contains several key terms that determine your overall cost. Mastering how to lease Lexus requires understanding what these terms mean and how they affect you. The money factor is the interest rate in leasing, though it’s expressed differently.

To convert money factor to APR, multiply by 2,400. For example, a money factor of .00125 equals 3% APR. Dealers sometimes mark up the money factor from what Lexus Financial Services offers, so ask for the buy rate and negotiate this just like you would an interest rate on a loan.

Residual value represents what the Lexus will be worth at lease end, expressed as a percentage of MSRP. This is set by Lexus Financial Services and isn’t negotiable, but it dramatically affects payments. Higher residual values mean lower payments because you’re paying for less depreciation. Lexus vehicles typically have strong residuals due to their reliability reputation.

Annual mileage allowance is crucial when figuring out how to lease Lexus for your situation. Standard leases offer 10,000 or 12,000 miles per year, with 15,000 available for higher payments. Be honest about your driving habits. Excess mileage charges (typically 15-25 cents per mile) add up quickly if you underestimate. It’s usually cheaper to buy extra miles upfront than to pay penalties at lease end.

Lease term length affects monthly payments inversely—longer terms mean lower payments but more total interest paid. Most Lexus leases run 36 months, which balances affordable payments with staying within warranty coverage. The 39-month term is also popular. Avoid very short (24 months or less) or very long (48+ months) leases unless you have specific reasons.

Evaluating Lease Offers: How To Lease Lexus With Best Incentives

Lexus regularly offers lease specials that significantly reduce costs. Knowing how to lease Lexus with maximum incentives means understanding and evaluating these programs. Manufacturer lease cash directly reduces the capitalized cost, lowering your payment without requiring a larger down payment from you.

Subvented leases feature artificially low money factors subsidized by Lexus Financial Services. These promotional rates can be substantially below market interest rates, making specific models very attractive to lease. Subvented leases usually apply to models Lexus wants to move quickly—either slow-selling models or outgoing model years.

When researching how to lease Lexus, check the official Lexus website for current national offers. Then contact local dealers to ask about regional incentives, which can add to national programs. Some regions offer additional lease cash based on local market conditions.

Conquest and loyalty programs reward customer behavior. Conquest incentives offer bonuses if you’re currently leasing a competitor brand (like Acura, BMW, or Mercedes-Benz). Loyalty programs reward existing Lexus customers returning for another lease. These bonuses typically range from $500 to $2,000 and can be combined with other incentives.

Compare lease offers across multiple Lexus dealers. While incentives are standardized, dealer fees and markup on money factors vary. Getting quotes from three or four dealers gives you negotiating leverage and ensures you’re getting competitive terms on how to lease Lexus in your market.

Also Read: How to Evaluate Cadillac vs Lexus for Your Needs 2026

Handling the Down Payment: How To Lease Lexus Wisely

The down payment (capitalized cost reduction) deserves careful consideration when determining how to lease Lexus. Advertisements often show attractive monthly payments based on substantial down payments of $3,000-$5,000 or more. While larger down payments reduce monthly costs, they’re generally not advisable for leases.

Here’s why: if the leased Lexus is stolen or totaled shortly after you take delivery, insurance pays the leasing company the vehicle’s actual value. Your down payment is simply gone—you don’t get it back. You’re out thousands of dollars and without a vehicle. This is called gap risk, and it’s why minimizing down payments makes sense when learning how to lease Lexus.

A better strategy is to make minimal or zero down payment and apply that money toward higher monthly payments if you want to reduce the finance charge. This way, if something happens to the vehicle, you’ve only lost one month’s payment rather than a large lump sum.

If you have a trade-in, consider selling it privately rather than using it as a down payment on your Lexus lease. You’ll typically get more money selling privately, and you avoid the same gap risk. If you do trade in, understand its value separately from the lease negotiation to ensure you’re getting fair value.

Some Lexus lease deals require a specific down payment to achieve the advertised rate. In these cases, evaluate whether the promotional terms with required down payment are better than a standard lease with minimal down payment. Do the math on total cost rather than just comparing monthly payments.

Completing the Process: How To Lease Lexus Successfully

Once you’ve negotiated terms, reviewed the lease contract carefully before signing. This final step in how to lease Lexus protects you from costly mistakes. Verify that all negotiated terms appear in the contract: the agreed capitalized cost, money factor, residual value, mileage allowance, and lease term.

Check for unwanted add-ons. Dealers sometimes include paint protection, fabric protection, or extended warranties in the contract without clear disclosure. These increase your capitalized cost and monthly payment. If you don’t want them, have them removed before signing.

Understand wear-and-tear policies. Lexus Financial Services defines normal wear versus excessive wear that results in charges at lease end. Knowing these standards helps you protect your vehicle during the lease term. Consider whether wear-and-tear protection makes sense for your situation.

Gap insurance is typically included in Lexus leases, but verify this in your contract. Gap insurance covers the difference between what you owe and the vehicle’s actual value if it’s totaled. This is separate from the gap risk we discussed regarding down payments.

Review all fees carefully. Acquisition fees (around $650-$1,000) are standard and typically non-negotiable. Documentation fees vary by dealer and state but shouldn’t exceed a few hundred dollars. Registration and taxes are what they are, but verify the amounts are correct.

Maintaining Your Lease: How To Lease Lexus and Keep It Perfect

After signing, protecting your investment becomes paramount. Proper maintenance is essential when learning how to lease Lexus, as you’re responsible for returning the vehicle in good condition. Follow Lexus’s maintenance schedule precisely, keeping all service records to prove proper care.

Use authorized Lexus service centers when possible. While not required by law, Lexus dealers have specialized training and genuine parts. This is particularly important for warranty and lease-end purposes, as using a Lexus dealer eliminates any question about service quality.

Address minor damage promptly. Small dents, scratches, or windshield chips are easier and cheaper to fix immediately than dealing with them at lease end. Lexus’s wear-and-tear guidelines allow minor imperfections, but anything beyond normal use will incur charges.

Track your mileage throughout the lease. If you’re approaching your limit with significant time remaining, you can purchase additional miles before lease end at a lower rate than excess mileage charges. Alternatively, you might choose to buy the vehicle if you’ve exceeded mileage limits significantly.

Keep the vehicle clean and well-maintained cosmetically. While you won’t face charges for normal wear like minor seat wear or carpet fading, keeping the Lexus in excellent condition makes lease return inspections smoother and reduces potential charges.

Planning Lease End: How To Lease Lexus Again or Move On

As your lease term approaches its conclusion, understanding your options completes your knowledge of how to lease Lexus. You typically have three choices: return the vehicle and walk away, purchase the Lexus for its residual value, or return it and lease or buy another vehicle.

Schedule a pre-inspection several months before lease end. Lexus Financial Services offers inspections to identify potential excess wear charges in advance. This gives you time to repair issues yourself, potentially saving money versus paying Lexus’s charges.

If you plan to lease another Lexus, contact your dealer about three months before lease end. Early ordering allows you to time the transition smoothly, and dealers often waive some fees for loyal customers. They may also be more flexible on excess wear charges if you’re continuing with another Lexus lease.

Buying your leased Lexus makes sense if you’ve exceeded mileage limits significantly or if the market value exceeds the residual value (rare but possible). Calculate whether purchasing is better financially than paying excess charges and starting a new lease.

If returning the vehicle and not getting another Lexus, thoroughly clean and detail it before return. First impressions matter during lease-end inspections, and a clean, well-presented vehicle often receives more lenient treatment on minor wear items.

My Final Thoughts:

Mastering how to lease Lexus transforms a potentially stressful process into a straightforward transaction. By understanding lease terminology, negotiating effectively, timing your lease strategically, and maintaining your vehicle properly, you position yourself to enjoy luxury driving without excessive cost.

Remember that leasing isn’t right for everyone. If you drive more than 15,000 miles annually, prefer owning vehicles long-term, or customize your cars extensively, buying might serve you better. But for people who enjoy driving new vehicles every few years, want predictable costs, and stay within mileage limits, leasing a Lexus offers an attractive path to luxury.

The key to how to lease Lexus successfully lies in preparation, research, and negotiation. Approach the process informed and confident, understanding that dealers expect negotiation and respect customers who know what they’re talking about.

With the information in this guide, you’re equipped to secure excellent terms on your next Lexus lease and enjoy the luxury, reliability and prestige that the brand delivers.

FAQs

How does leasing work with Lexus?

Lease customers often benefit from lower monthly payments and putting less cash upfront compared to a traditional finance contract. Lexus offers flexible 24-60 month lease terms on both new Lexus models and L/Certified by Lexus vehicles, though vehicle age may affect L/Certified eligibility.

What’s the catch when you lease a car?

Leasing a vehicle can come with several potential charges and fees that drivers should be aware of. Most lease agreements include costs such as excess mileage fees, wear and tear charges, and early termination fees, which can accumulate over time.

What are you actually paying for when you lease a car?

Leasing allows drivers to pay for the vehicle use without owning it, as the finance institution retains vehicle ownership throughout the lease term. This structure results in lower monthly payments compared to buying a car, making it an attractive option for many drivers.

What to do before signing a lease?

Before signing an apartment lease, it’s important to review the lease terms carefully and ask about subletting policies in case your plans change. Make sure you understand how emergency repairs are handled and your tenant responsibilities regarding damages, renovations, and timely rent payments.

What are red flags in a lease?

When signing a lease, it’s important to watch for red flags that could cause issues later. Pay attention to unclear terms and ensure full lease clarity, as vague language can lead to misunderstandings about tenant responsibilities and tenant rights.

I’m Kainat Ansari, with 3+ years immersed in everything Lexus—from advising first-time ES buyers to tracking down rare RC F Track Editions for performance enthusiasts. I combine technical knowledge of hybrid systems, F Sport packages, and cutting-edge safety tech with practical expertise in lease programs, certified pre-owned advantages, and real ownership costs. My goal is simple: help people understand why Lexus builds some of the most reliable, refined luxury vehicles on the road and find the perfect match for their lifestyle.